The Global Circuit

Does the US Dollar Matter Anymore

Yes, we were all nervous a few months ago—understandably—but things didn’t go nearly as badly as we feared. Some risks have faded or been reversed, and the economy, while slower than last year, is still moving forward. It’s a cautiously optimistic stance grounded in relief that earlier worries have not turned into real problems and there are three primary reasons why investors, including ourselves were somewhat hesitant.

Softening Economic Data

While economic indicators earlier in the year showed signs of slowing, which raised obvious concerns. Those worries have somewhat eased: some data has improved, while other areas remain uncertain. Crucially, the economy hasn’t fallen apart, so the worst-case scenarios did not materialize.

Oh, yah and how about that "Rose Garden Moment" initially causing market anxiety “absurd” display of utter chaos in the White House, eventually it was reversed, implying it was a nothing burger in the end, as Trump walked it back a several days later.

Tariff and Earnings Fears Concerns

There was general concern about what earnings would look like with any kind of tariffs interfering with the cost of doing business. Tariffs (perhaps new or threatened ones) would hurt corporate earnings by increasing business costs. Those fears have not materialized significantly, meaning earnings have held up better than anticipated. The next quarter may also be reasonably good as there was a lot of carry forward in consumer spending ahead of the tariff threats. We will see how that unfolds in the coming weeks. The economy is not grinding to a halt, contrary to earlier fears. Growth has slowed compared to 2023, but not as much as expected. So, while not spectacular, the economic trajectory is stable or moderately positive.

Interest Rate Fears Are Minor

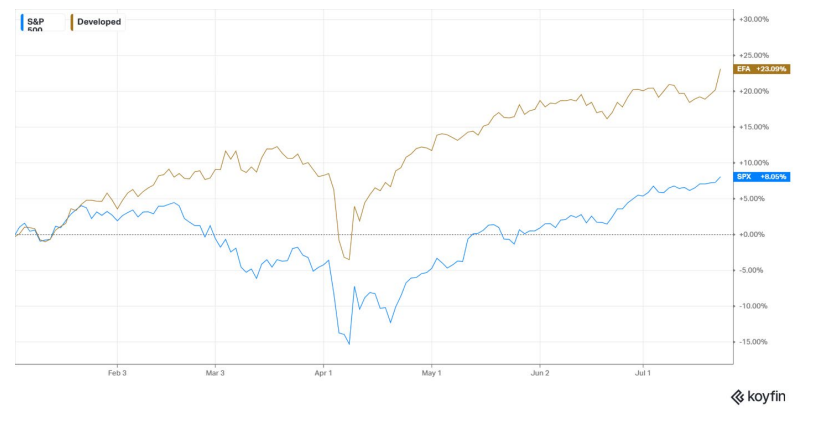

A spike in the 10-year Treasury yield could rattle markets temporarily ("a little bit of a puke") for a few days and then fears from bond vigilantes eventually dissipates. The Weakening Dollar however Is a Major Trend vs. the risk from U.S. interest rates, which emphasizes a powerful bullish narrative: a weakening dollar is helping to drive an international stock renaissance. With outperformance not seen in over two decades, this trend is reshaping how investors feel about global exposure—and it’s finally paying off after years of underperformance. This is significant because international stocks have been a drag for many years. The performance gap is now the widest since 2001. The gap is 15 percentage points ahead of U.S. stocks year-to-date through today. Investors are no longer just reliant on the S&P 500 for returns. Seeing gains across diverse global holdings boosts confidence and can reshape portfolio strategies.

Another benefactor of the declining US dollar has been gold. Everything is shining bright in the precious metals market and is seen as a proxy currency to others like the USD. This pattern is well established over the last 50 years since the USD decoupled from the gold standard. As the US dollar declines, the price of gold rises and reinforces this negative correlation. By contrary, if the USD gets a bid this can reverse that link and can have very volatile consequences. last noted in late 2011 when gold peaked at $ 1897 an ounce before it began a sudden collapse to $1051 an ounce, a 45% drop as the US dollar began its recovery off the Great Financial Crisis, leading to one of the strongest bull market periods in history. For now, gold is reflecting a weakening US dollar alongside geo-political risks like trade wars and real wars. The same can be said about Bitcoin

“So, the moral of the story is don’t bet against the US, as history will likely repeat itself”